Small businesses on the rise typically face a few pivotal points as they grow—not the least of which is deciding to turn their accounting over to a professional. It’s an investment many can’t afford not to make, as more (and more complicated) transactions, vendors, and expenses often require accounting expertise the average business owner doesn’t possess.

An accountant can be an invaluable partner for the future of a business, so it’s important to choose whom you entrust your finances to carefully. Your business is unique—your story, products, services, mission, market, and customers—and therefore, so are your accounting needs. In this article, we’ll provide a framework for hiring an accountant who can help your business continue to grow.

IDENTIFY YOUR BUSINESS’S ACCOUNTING NEEDS

To give potential candidates all the information they need about your company, consider creating a document that acts like a “brief”of your business and finances, which can eventually serve as the first draft for a job post. Consider finding an accountant with experience in general, day-to-day accounting services as well as accounting needs unique to your industry.

Start high-level by thinking about your particular industry and any nuances, regulations, and other specifics an accountant should be aware of to make the most sense of your financials (it’s ok if you don’t know this yet and need to ask an expert for help). Explain your business model, the size of your operation (including any professionals working with you), expenses, challenges, and opportunities.

For instance, an accountant with expertise in helping small, local retailers may be a great fit for a local bicycle shop expanding into a new location. But, he or she might not be the best fit for a software-as-a-service (SaaS) online business that’s expanding with teams of remote developers in different countries, partnering with cloud providers, and monetizing a suite of APIs to customers across the globe.

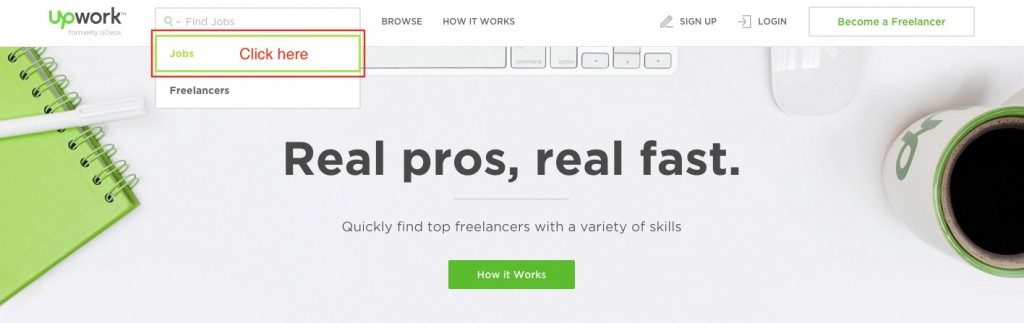

Find Top Accountants on Upwork

Also, consider your financial needs in a few years’ time, not just your business’s needs right now. Include a line in your brief that forecasts business goals and what your potential needs may be as you grow to help you align with an accountant prepared to guide you down that path.

Next, make a checklist of all of the industry-neutral accounting items you need help with. Note all the accounting items you’ve handled on your own so far, whether it’s with accounting software or otherwise, and the wishlist items you’d like help with. These can include the following:

- Monthly tax filings

- Profit and loss statements

- Paying for everyday expenditures

- Recording forms of income

- Verifying deposits and other transactions

- Balancing bank accounts

- Billing clients directly

- Managing past-due accounts

- Preparing monthly financial statements

- Handling payroll and withholding taxes

- Generating business reports

Finally, do your best to estimate your budget and timeline. Do you need a year-round consultant to help you maintain your books and work with payroll and vendors? Or is this engagement on more of a project basis (say, around tax time)? Once you’re able to nail down timing, deliverables, and schedule, check out this article in which we provide a general framework to help you estimate a budget for an accountant.

Cost will largely depend on the amount of work, the turnaround, expertise including advanced degrees, and the complexity of tax laws in your industry and country. It’s worth taking a look at different accounting certifications so you understand a potential accountant’s profile or resume, e.g. CPA, auditor, financial planner, and more.

HOW TO WORK WITH YOUR NEW ACCOUNTANT

If you’re scaling up in all areas of your business, you’re likely working to establish new processes as you grow. How you work with your business’s accountant is no different. A few important criteria to include in your job post are:

- Workflow: What will you need completed? Are they recurring?

- Communication: How will the accountant communicate with you?

- Technical: What’s your current process? What software do you use? Do they need access to certain portals or systems?

- Preference: What are some certifications or areas of expertise you’d like to see?

- Project Length: How long do you anticipate needing an accountant?

- Deadlines: Are there any impending timelines? When will you start needing help?

DOES MY BUSINESS NEED AN ACCOUNTANT?

You may think that your startup or small business is not big enough to warrant an accountant, but unless you’re an expert in tax and finance (in other words, an accountant yourself), this simply is not the case. The financial aspects of running a business change on a regular basis– from keeping your books up to date, approaching funding sources or doing market analysis–and an accountant provides your business with a great deal of essential support and time savings. They can also help with protection from fraud, loss, fines, and compliance regulations that can create liabilities for small businesses.